Security Update Coming

DATE

Security and protection are vital features when it comes to banking.

On DATE, we will be launching a new security feature that will integrate stronger cybersecurity protections to detect fraud, while ensuring you have a positive online banking experience.

Every time you login to Online Banking, the new security feature will not only confirm your credentials but also the device you are using. If the system detects a new device or suspicious activity, you may be asked to further verify your identity via a one-time passcode sent to your phone. Your enrollment in this new security feature is required.

How-To Videos

Learn about the security enrollment process with this step-by-step tutorial.

Simple Set Up:

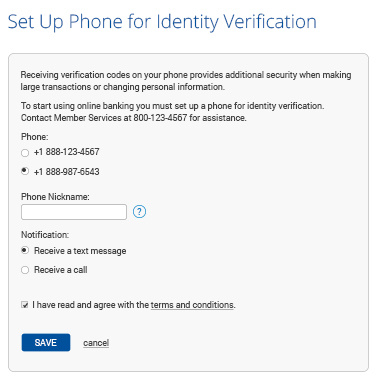

For future identity verifications, all we need is a phone number. Starting DATE, when you log into your Online Banking account through our website or Mobile Banking app, you will be asked to set up your phone number and choose your preferred delivery method – text message or phone call.

You will then receive a text message or phone call containing a passcode. Enter this passcode during log in to complete your phone number verification. Once entered, you will be logged into Online Banking.

How this feature will work in the future:

This new security feature will only be activated if our system detects a login attempt that falls outside of how you typically login or suspicious activity is suspected, for example a large, unusual transaction occurs or changes to your account information have been made.

When this happens, you will be prompted to enter a passcode during log in. The passcode will be sent to the phone number you set up previously using your preferred delivery method. Simply enter the passcode to complete your log in.